How to Cite a Website No Author Apa

You're reading Entrepreneur United States, an international franchise of Entrepreneur Media. This story originally appeared on Zacks

At its September investor update on Wednesday, APA Corporation APA reiterated focus on its debt-reduction goals and stressed on its ability to generate robust free cash flows, among others. According to the presentation, the U.S. oil company's net debt will be around $6 billion at the end of this year, down from $6.8 billion as of Jun 30. APA also looks poised to start increasing the pace of cash return to its investors.

The company has opportunistically bought back its debt to improve its financial position. In August, APA repurchased $1.7 billion in debt via an upsized tender offer, and rating agencies took notice. Moody's upgraded the company's outlook from negative to stable. The tender offer will also allow the upstream operator to reduce its annual interest expense by 20% (or approximately $78 million). Last but not the least, it has improved APA's debt maturity profile by lowering large tranches to $700 million or less.

At the same time, APA is on track to generate $1.6-$1.7 billion in upstream free cash flow for the full year, assuming current strip prices for the second half of 2021. This, together with the company's aggressive cost management initiatives, should help in its debt reduction goal and achieve its leverage target of less than 1.5 times debt-to-EBITDA. Meanwhile, APA's annual investment requirement will be some $1.2 billion.

Throwing light on its worldwide drilling operations, the company said that it has two rigs in the Permian Basin, eight in Egypt, and is maintaining a single floating rig and platform crew in the North Sea. APA sees strong performance from its Permian and Egyptian assets through the remainder of 2021 but has warned about planned and unplanned operational downtime in the North Sea, which will affect annual volumes and unit costs.

APA's Suriname portfolio is particularly exciting, where it continues to achieve significant drilling success with four discoveries since January 2020. The company has partnered with TotalEnergies TTE in this region, which lies off the north coast of South America. Over time, Suriname is expected to become one of APA's major assets with significant cash flow potential.

Management of this Zacks Rank #3 (Hold) firm — whose peers include Marathon Oil MRO and Hess HES — is guiding for total adjusted production of around 335,000 barrels of oil-equivalent per day (BOE/d) in the third quarter and the full year.

You can see the complete list of today's Zacks #1 Rank stocks here.

With the rise of ESG (Environmental, Social and Governance) investing and a broad-based transition toward clean energy, APA is also striving to reduce its carbon footprint. As part of that, the Houston, TX-based firm is aiming to do away with U.S. onshore routine flaring by the end of the current quarter. As it is, APA has achieved more than its 2021 targets for flaring intensity and freshwater consumption. Sticking to an environment-friendlier line, the company has tied 20% of 2021 annual incentive compensation plan to ESG and safety goals.

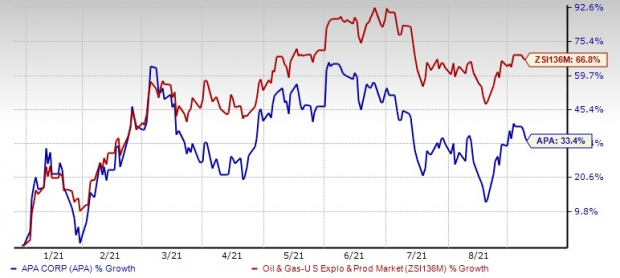

While APA shares have largely underperformed the industry year to date (+33.4% versus +66.8%), we believe that the company is trending toward the right direction, which will help the stock catch up.

- Zacks

Image Source: Zacks Investment Research

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the "Internet of Money" and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we're still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks' has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

How to Cite a Website No Author Apa

Source: https://www.entrepreneur.com/article/384881